The Finance Act, 2020, inter-alia, inserted clause (23FE) in section 10 of the Income-tax Act,

1961 to provide for exemption to wholly owned subsidiaries of Abu Dhabi Investment Authority (ADIA), sovereign wealth funds (SWF) and pension funds (PF) on their income in the nature of dividend, interest and long-term capital gains arising from investment made in infrastructure in India, during the period beginning with 01.04.2020 and ending on 31.03.2024 subject to fulfilment of certain conditions. In order to incentivise infrastructure investments by specified persons in India the Finance Act, 2021, hereinafter referred to as “Finance Act” amended the provisions of clause (23FE) of section 10 of the Act, which are disclosed in circular issued by CBDT.

Other Resources

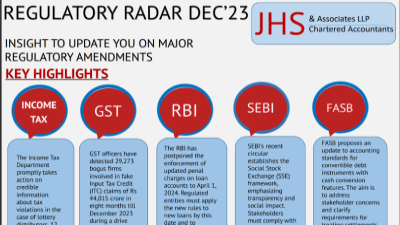

Regulatory Radar DEC’23

17 January 2024

Company Incorporation Procedure

17 November 2023

GST Registration Process

17 November 2023

PAN and TAN Registration Process

17 November 2023