Circular No. 20/2021 dated 25th November, 2021 Guidelines under sub-section (4) of section 194-0, sub-section (3) of section 194Q and subsection (I-I) of section 206C of the Income-tax Act, 1961 issued pertaining to the following: a. E-auction services carried out through electronic portal. b. Adjustment of various state levies and taxes other than GST c. Applicability of section 194Q of the Act in cases where exemption has been provided lInder section 206C (1 A) of the Act and d. Applicability of the provisions of section 194Q in case of department of Government not being a public sector undertaking or corporation.

Other Resources

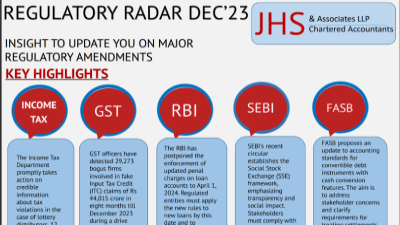

Regulatory Radar DEC’23

17 January 2024

Company Incorporation Procedure

17 November 2023

GST Registration Process

17 November 2023

PAN and TAN Registration Process

17 November 2023