The Central Board of Direct Tax notified that in the exercise of the powers conferred by section 89A hereby amend the rules of Taxation of income from retirement benefits account maintained in a notified country; Where a specified person has income accrued in a specified account or accounts, during a previous year relevant to any assessment year beginning on or after the 1st day of April 2022, such income shall, at the option of the specified person, be included in his total income of the previous year relevant to the assessment year in which income from the said specified account or ac- counts is taxed at the time of withdrawal or redemption, as the case may be, in the notified country.

Other Resources

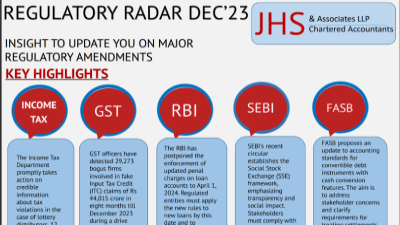

Regulatory Radar DEC’23

17 January 2024

Company Incorporation Procedure

17 November 2023

GST Registration Process

17 November 2023

PAN and TAN Registration Process

17 November 2023