SEBI\’s LODR Amendments: Enhancing Governance and Disclosure Standards

SEBI has introduced several key changes to the LODR Regulations in the past year, aiming to bolster corporate governance and disclosure norms for listed Indian entities.

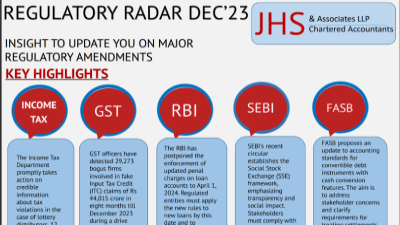

Notably, listed firms must now reveal material events exceeding specific value thresholds, as per circular SEBI/HO/CFD/CFD-PoD-1/P/CIR/2023/123. This move seeks to enhance disclosure quality and offer investors insights into events impacting investments.

Additionally, circular SEBI/HO/CFD/PoD-2/P/CIR/2023/4 allows limited relaxation for compliance in cases of AGMs via electronic means. These amendments bolster investor safeguards and foster Indian capital market growth, reinforcing the need for listed entities to grasp and adhere to these changes for effective governance.