Finance Act, 2022 made certain amendments to provisions of Section 206AB and 206CCA of the ITA, 1961. Thereby the definition of “specified person” has been amended in both section 206AB and section 206CCA. Now w.e.f. 1st April 2022, \”specified person\” means a person who satisfies both the following conditions:

(a) He has not furnished the return of income for the assessment year relevant to the previous year immediately preceding the financial year in which tax is required to be deducted/collected . The previous year to be counted is required to be the one whose return filing date under sub-section (1) of section 139 has expired.

(b) Aggregate of tax deducted at source and tax collected at source is rupees fifty thousand or more in that previous year.

Other Resources

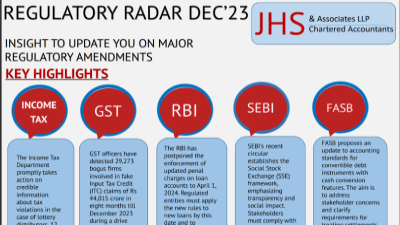

Regulatory Radar DEC’23

17 January 2024

Company Incorporation Procedure

17 November 2023

GST Registration Process

17 November 2023

PAN and TAN Registration Process

17 November 2023